International taxation sources

Introduction

The purpose of this guide is to inform students about the most important available sources of international taxation law. Faculty members from the Department of Business Law helped us creating this guide. It contains Corvinus Library information, as well as, external sources. Among the library materials you may find legal databases, tips for searching printed and electronic journals, ebooks, while external sources focus on sources available at no charge. Printed materials in this topic can be found in the library’s catalogue.

Subscribed legal databases

| Database | Short description |

| Jogtár (Wolters Kluwer) | Selected Hungarian laws in force in English and German |

| The Max Planck Encyclopedias of International Law | The database is a comprehensive, analytical resource containing peer-reviewed articles on every aspect of international law. This definitive reference work contains both the Max Planck Encyclopedia of Public International Law (MPEPIL) and the Max Planck Encyclopedia of International Procedural Law (MPEiPro). MPEPIL is a major online reference work contains 1,700+ peer-reviewed articles on every aspect of the substance of international law. MPEiPro maps and analyzes the systems and processes through which international law is made and adjudicated in practice. The Encyclopedia will eventually contain over 1500 entries. Both are searchable on the same platform simultaneously. |

Legal e-journals, e-books

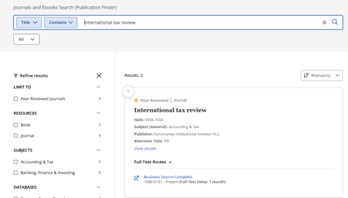

For searching journals and ebooks use the specific search box (Publications) from the Library’s homepage. Search is to be carried out on the basis of the title of the journal or ebook. All items contain full text.

Example:

How to interpret the result? The journal is accessible in Business Source Complete database in the given period (From July, 1998-until present time) with a one-month embargo.

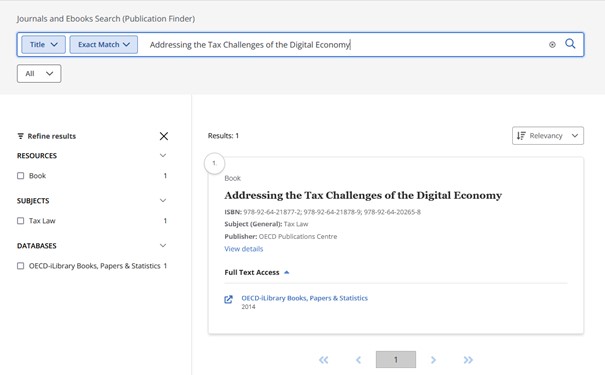

To find a certain ebook or journal, please use quotation marks: e.g. “Addressing the Tax Challenges of the Digital Economy”

Besides specific documents, searching for a topic is also possible. In this case, all titles will be listed that contain the search.

Corviversum

Corviversum (Corvinus repositories) contains MSc/BA Theses, PhD-Dissertations, and Corvinus Research Papers. Examples for ech categories are as follows:

External sources

Please find bellow a collection of useful external links in the field of International taxation with some explanations as to their nature.

| SSRN (LSN) | Open access scholarly platform that helps researchers publishing manuscripts and accessing the publication of others. The platform itself is multidisciplinary, for legal professionals following the documents of Legal Scholarship Network (LSN) is recommended. Pubished materials are grouped into different thematic journals, check them under Research Paper Series. |

| Kluwer International Tax Blog | Legal experts of Kluwer Law International Publishing maintain this blog about hot topics in international taxation. It contains analyses, comments, short summaries. |

| OECD.org/ tax | Freely available OECD-documents about taxation. Documents can be searched by countries or date, or by topics (i.e. tax). |

| Worldbank Doing Business | The Doing Business project provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational and regional level. The project launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them through their life cycle. |

| National Legislation Database – Translated legislation | The webpage contains English translations of Hungarian laws prepared within the framework of the legislation translation program of the Ministry of Justice of Hungary. |

| EurLex | EUR-Lex is your online gateway to EU Law. It provides the official and most comprehensive access to EU legal documents. It is available in all of the EU’s 24 official languages and is updated daily. |

| Curia | The database contains all cases ruled by the European Court of Justice or the General Court. It can be best searched by the case number or by the name of the parties. |

| USA Model Income Tax Convention | The text of the current US Model Income Tax Convention and other documents about international taxation are available at the official website of the US government. |

| Transfer pricing cases | TPcases.com provides a free and fully searchable database of international transfer pricing case law, guidelines, investigations and country profiles. Originally non-English materials are computer-translated. |

| IBFD.org Bookshop | Wide variety collection of IBFD-books about transfer pricing, tax treaty law, value-added tax and corporate taxation. The collection contains free titles; to access them, click Open Archive. |