State pensions alone do not protect people from poverty in old age anywhere in Europe

.jpg)

The number of people at risk of poverty should be reduced by 15 million by 2030, according to the European Union’s 2017 Action Plan. In comparison, the proportion of poor elderly people in European countries has increased significantly over the last ten years, with 16.8% of people over 65 living below the poverty line in 2021, so social security pensions alone do not provide a stable financial support. This is why it is important to understand the links between poverty and self-care in old age – the relevant data from 25 European countries were analysed by Ágnes Vasköv researcher of the Corvinus University of Budapest, who presented the results at two scientific conferences in June. From macro data, the researcher considered national economic and poverty indicators, life expectancy and retirement age, as well as old age and pension income, and from micro data, variables that show the proportion of older people who have invested their savings in shares, investment funds, individual retirement accounts, life insurance or business ownership.

Hungary in the middle category

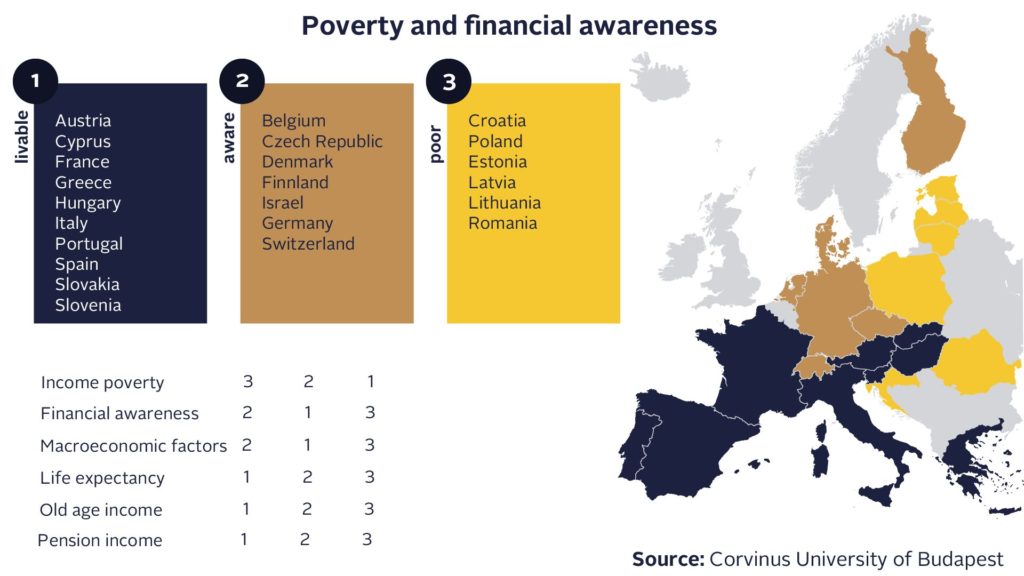

The study divides the countries analysed into three distinctive groups: conscious, livable and poor. In the ‘conscious’ group – mainly in Northern and Western European countries such as the Belgian, Czech, Finnish and German societies – citizens plan ahead, are active and use a wide range of financial products to invest in the future, their country is in good economic shape but the pension system is not generous, many still work while they are retired.

The middle category, ‘liveable’ countries, includes Hungary, where the economic situation is average, the expected poverty rate in old age is relatively low, but the relatively generous pension system does not provide much incentive for people to take care of themselves. The category also includes Austria, France, the Mediterranean countries, Slovakia and Slovenia.

In the third group, labelled ‘poor’, in the Baltic States, Croatia, Poland and Romania there are many poor elderly people who have to work to support themselves because of a low pension income, a shorter life expectancy, less financial awareness and a poor economy.

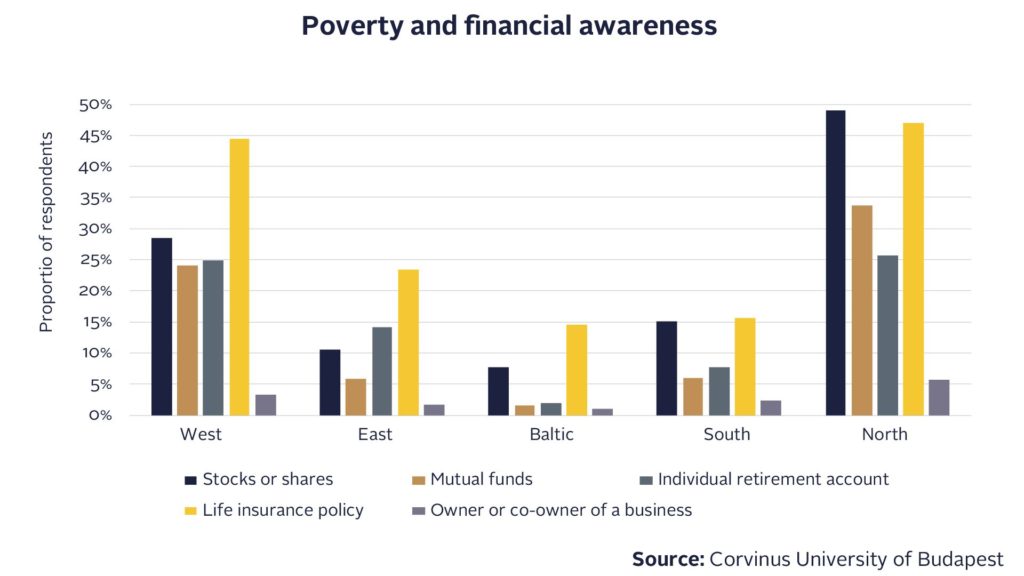

Czechs swear by individual pension accounts, Germans by life insurance

From the source data, it is worth highlighting that Czechs open the highest number of individual retirement accounts during their active years (almost two-thirds) of the self-care instruments in the countries surveyed, Germans lead in life insurance (60.2%), Danes are the most frequent buyers of securities and companies (59 and 6.5% respectively), while investment funds are the most popular among Finns (39.9%). The worst performers in almost all categories are Bulgarians (between 0.4% and 4%), with Latvians being the least confident in investing in business ownership. In Hungary, life insurance is the most popular form of saving among respondents (34.8%), 9.2% have opened an individual pension account at least once, 5.2% have bought securities, while investment funds and company acquisitions were chosen by only around 3% of respondents.

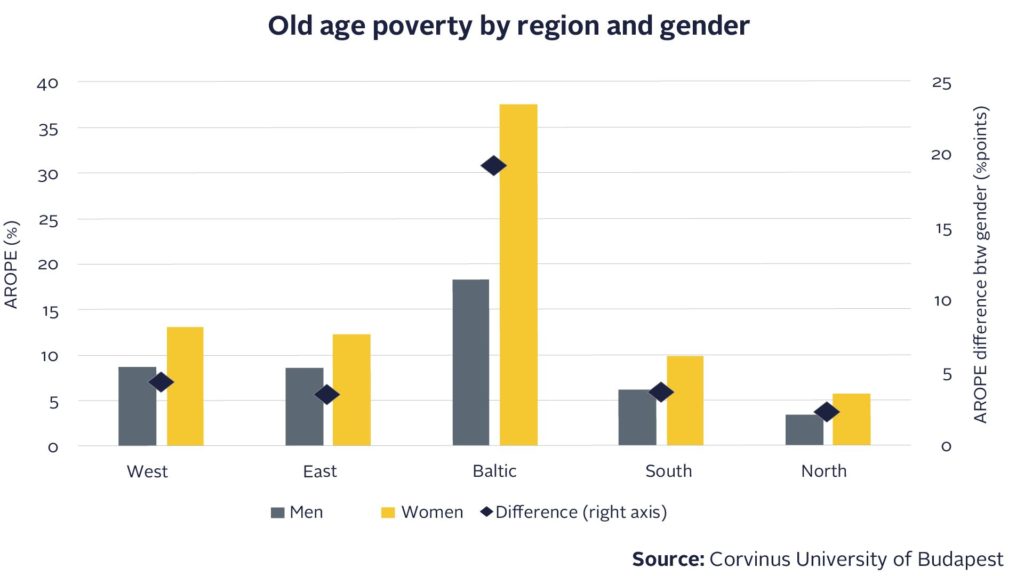

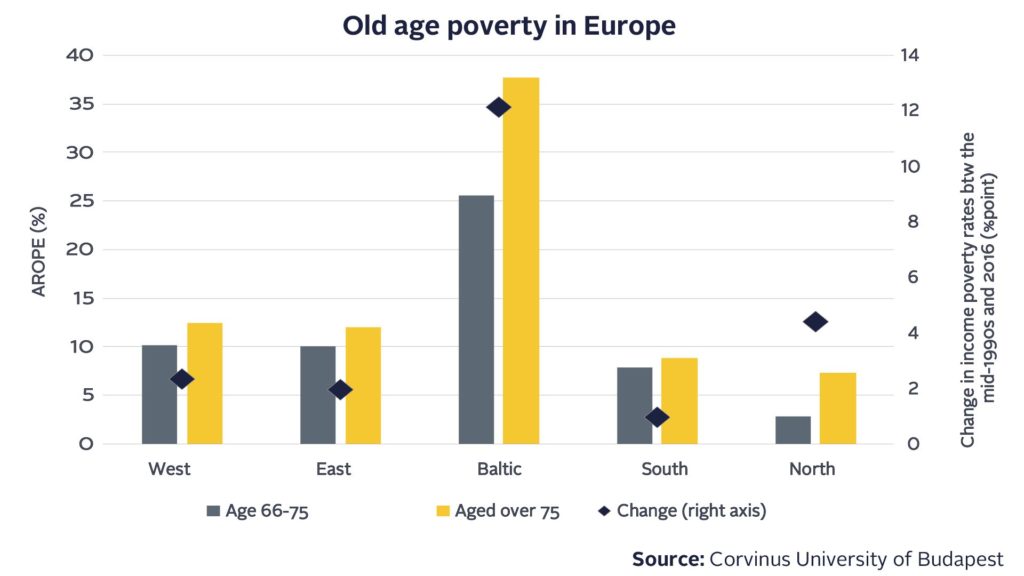

The researcher measured the risk of poverty using data from the European AROPE indicator, which shows individuals whose income is less than 60% of the median income of the total population. The over-65s are most at risk in the Baltic States, where a quarter of the age group is affected, and around 37% of the over-75s, especially elderly women, are in a critical situation. The average for Eastern and Western European countries is 10 and 12-13% respectively, while in the more prosperous Nordic countries it is only a few percent. In Hungary, the AROPE is favourable at 5.9% for people aged 65-75, and almost uniquely even lower at 4.3% for people aged 75+. The gender gap is also not significant, with women over 65 having a 0.7 percentage point higher risk of poverty than men.

Ágnes Vaskövi presented her research at the 35th Operational Research Conference at the Corvinus University of Budapest and the 37th International Conference on Modelling and Simulation in Florence. The starting point of the research was Evelin Jászfi’s master thesis, written in 2021 in the Finance study programme at Corvinus University. The data used in the study comes from the OECD’s Pensions at a Glance 2019 review and the 2017 financial module of the SHARE Wave 7 survey covering almost 18,000 European pensioners.