Are Hungarians eating healthier since the introduction of the chips tax?

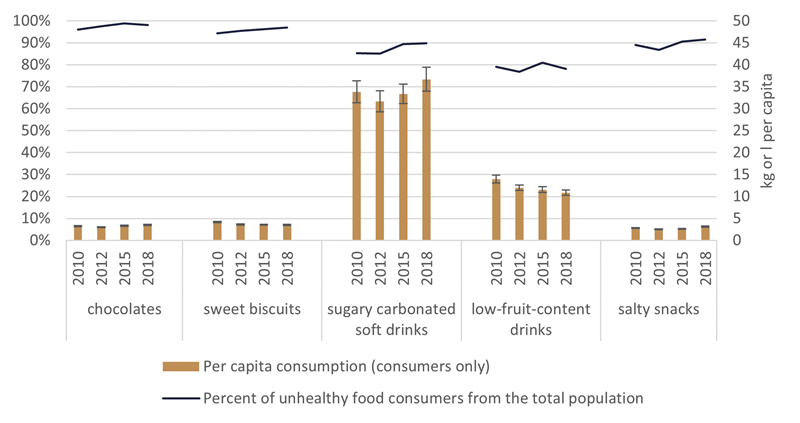

The public health product tax, nicknamed as chips tax, was introduced in Hungary 13 years ago with the intention of reducing the consumption of unhealthy products, in addition to increasing tax revenues. Corvinus researcher Zombor Berezvai and his co-authors examined how domestic consumption patterns have changed since the introduction of the tax in 2011. The researchers analysed representative data for 2,000 households from the GfK ConsumerScan household panel over a period of many years. They examined the consumption of chocolates, sweet biscuits, sugary carbonated soft drinks, salty snacks, and drinks with low (less than 25%) fruit content, which had accounted for more than 90% of the total sales of the taxed products before the introduction of the tax.

The authors found that although the tax on unhealthy foods initially reduced consumption, this was offset over time by the fact that dietary habits and the food environment did not change, and disposable income increased. Eight years after the introduction of the tax, Hungarians were already consuming more unhealthy foods than before the introduction of the tax – in several categories this increase even exceeded the EU average – and unhealthy foods accounted for a larger proportion of consumers’ total food spendings. The share of taxable products within the daily consumer goods purchases increased from 5.9% in 2010 to 7.4% in 2018. In other words, the tax has failed to achieve its main objective of reducing the consumption of unhealthy foods.

Complex measures are needed

The study published in the August issue of Health Policy also shows that the tax has caused social harm. “Taxing unhealthy foods alone will not reduce consumption in the long run and will increase social inequalities. As price increases are felt more acutely by lower income groups, such measures may even be detrimental to them, and the tax takes a larger share of their income than it does for richer households.,” Corvinus researcher Zombor Berezvai explains.

Therefore, the research draws attention to the fact that imposing tax on unhealthy foods will not, in itself, be sufficient. The authors of the study argue that to achieve long-term positive outcomes, complex measures are needed, such as making healthier foods more accessible and affordable, and raising consumer awareness through education programmes.